ONE+

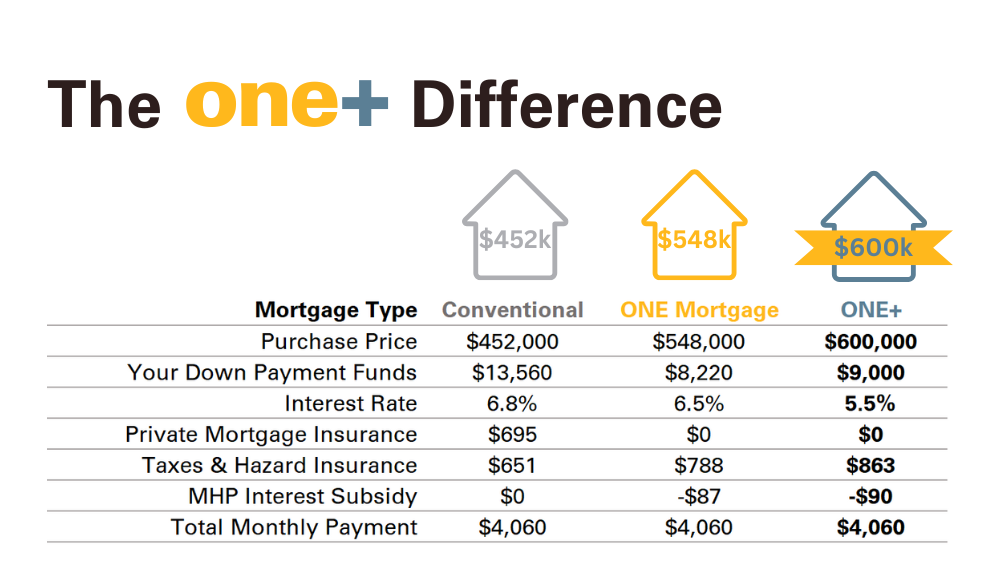

The ONE+ Mortgage Program builds on the affordable features of the ONE Mortgage Program to deliver affordable financing solutions for low- and moderate-income first-time homebuyers currently residing within 29 Massachusetts communities. Specifically, the ONE+ Mortgage Program adds a permanent interest-rate discount, down payment and closing cost assistance.

Features of ONE+

ONE+ lowers the cost of buying and owning a home in Massachusetts by providing the same great ONE benefits...

- Heavily discounted, fixed, 30-year interest rates

- No private mortgage insurance (PMI)

- Lower down payment requirement

- Additional financial assistance for eligible buyers

...with these additional features unique to ONE+:

- Enhanced down payment assistance

- Closing cost assistance

Homebuyer Eligibility

To qualify for ONE+ you must:

- Be a current resident of one of the following cities: Attleboro, Barnstable, Boston, Brockton, Chelsea, Chicopee, Everett, Fall River, Fitchburg, Framingham, Haverhill, Holyoke, Lawrence, Leominster, Lowell, Lynn, Malden, Methuen, New Bedford, Peabody, Pittsfield, Quincy, Randolph, Revere, Salem, Springfield, Taunton, Westfield, or Worcester.

- Be a first-time homebuyer. This means that you have not owned a home at any point in the last three years.

- Take a homebuyer class. This class will help you get ready for the home buying process. We accept any class on this list.

- Meet our down payment requirements. We require a 3% down payment to buy a condo, single-family home, or two-family home. At least 1.5% of the purchase price must be from your own savings. For a three-family property, we require a 5% down payment with at least 3% from your own savings.

- Have a total household income under our limits. Income limits vary by the community you are considering purchasing in. Check your community on this page.

- Have less than $100,000 in total household assets. This includes any checking accounts, savings accounts, stocks, or bonds. But it does not include most retirement (401k, 403b, 457, traditional IRA) and college savings accounts. It also does not include the money you receive from down payment programs.

- Meet our credit score limits. Your credit score must be at least 640 to buy a single-family or condo and at least 660 to buy a two/three family home. We also have options for people who don’t have any credit history.

- Agree to live in the property as your primary residence. If you stop living in the property, you must refinance out of your ONE Mortgage.

Buying a two- or three-family property? You must complete a pre-purchase multi-family/landlord course or meet with an approved agency for a one-on-one counseling session.

What are my next steps?

- Take a homebuyer education class

Find a class near you. The class will answer your questions about buying a home and tell you about other programs that can also lower your costs. - Contact a Participating ONE+ Lender

They'll help you get pre-qualified for ONE+. Find a ONE+ Lender. - Buy your first home!

If you have questions please send us an email.