Posted on August 23, 2018

Community Preservation Act (CPA) funds are the largest source of resources for most Affordable Housing Trusts (trusts).

Some Community Preservation Committees (CPC) recommend funding each year for the trust (e.g., Cambridge annually allocates 80 percent of CPA income to the trust and Somerville allocates about 45 percent). These trusts have the most flexibility implementing their mission and are essentially seen as the housing arm of the CPC.

Other CPCs require the trust to submit a proposal like every other applicant. A handful of CPCs only designate funding to a trust for a specific project. This is the most restrictive model and makes it challenging for a trust to fully benefit from the powers granted in the Municipal Affordable Housing Trust (MAHT) statute, such as moving nimbly in the real estate market.

Yet one thing is consistent: All trust allocations of CPA resources must be annually reported back to the state Community Preservation Act Coalition.

Changes made to the MAHT statute in 2016 specify that all CPA funds transferred to the trust must be accounted for separately from other resources and “…at the end of each fiscal year, the trust shall ensure that all expenditures of funds received from said chapter 44B are reported to the community preservation committee of the city or town for inclusion in the community preservation initiatives report, form CP-3, to the department of revenue.”

This directive applies to all CPA funds in the trust’s account. Trusts should detail all allocations, similar to the way that CPCs report projects in the CP-3. If a supported project changes, or is cancelled, this should also be reported to the CPC.

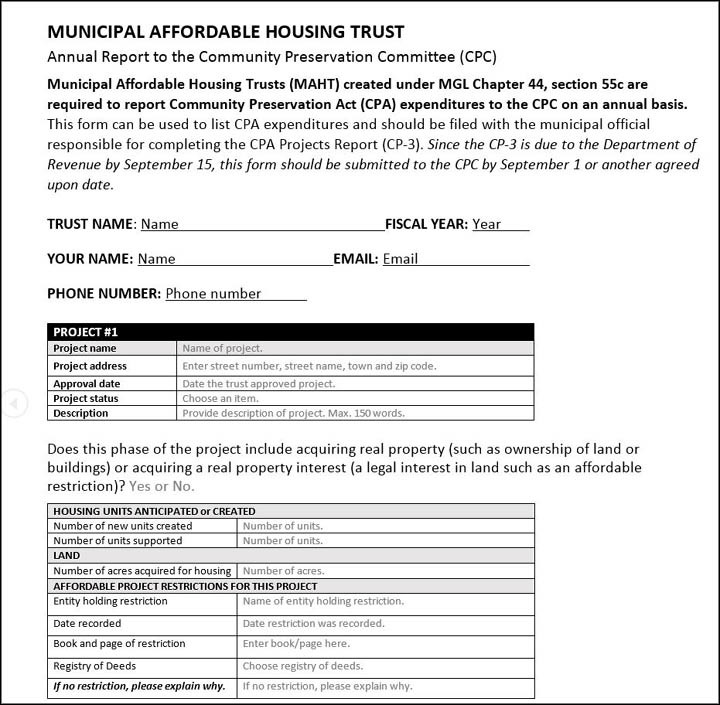

To assist trusts in reporting to the CPC, MHP worked with the state CPC to create this fillable form that outlines the information required in the Community Preservation Projects Report (CP-3). Directions on how to complete the form can be found here.

Since the CP-3 report is due to the Department of Revenue on September 15, trusts should submit their report to the CPC by September 1 or another agreed upon date.

For questions, contact MHP’s Shelly Goehring at 857-317-8525 or sgoehring@mhp.net.